What Is Negative Cash Flow in a Dental Practice?

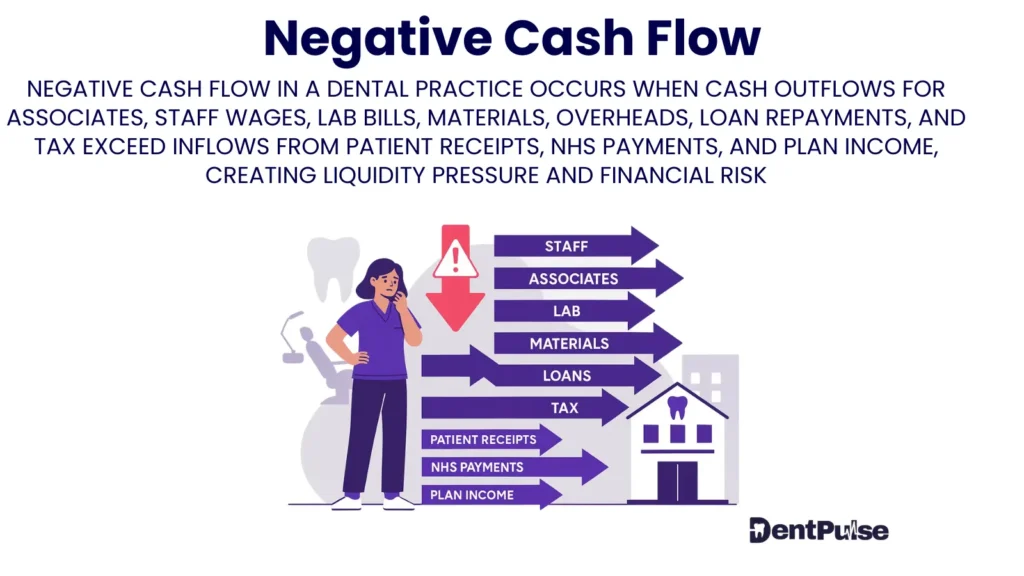

Negative Cash Flow occurs when your cash outflows exceed your cash inflows during a given period — meaning more money is going out (e.g. wages, rent, labs, tax) than is coming in (e.g. NHS, private, plan payments).

It’s not the same as being unprofitable.

You can show a profit on paper and still run out of cash.

Why Negative Cash Flow Matters for Dental Practice Owners

Negative cash flow is one of the biggest sources of stress for practice owners — often surfacing as:

- Overdraft reliance

- Missed payroll or tax payments

- Drawing delays

- Sudden cost-cutting or panic decisions

- Inability to reinvest or grow

Example:

You collect £42K in revenue this month, but:

- Associate pay: £18K

- Lab + materials: £6K

- Payroll + overhead: £22K

- Tax bill: £5K

→ Total outflow = £51K

→ Cash deficit = -£9K (even if P&L shows £5K profit)

What Causes Negative Cash Flow in Dentistry?

| Trigger | Impact |

| Timing Gaps | Patients pay late, but suppliers are due now |

| Excessive Drawings | Owners draw more than net profit or free cash |

| High Fixed Costs | Staff, rent, and software continue even when revenue dips |

| Overexpansion | Adding surgeries or associates without a cash buffer |

| Tax Shock | Surprise Corporation Tax or Self Assessment payments |

| Treatment Refunds | Revenue reversal without reversing cost |

DentPulse catches these issues before they hit — using live pairing logic and red–amber–green alerts.

How DentPulse Detects and Fixes Negative Cash Flow

| Feature | Function |

| LIQUIDIQ™ Engine | Flags when your 12-week buffer drops below safety |

| CFFP™ – Cash Flow Future Pairing | Highlights when future income can’t cover upcoming outflows |

| PPP™ Safeguard | Prevents drawings when cash isn’t available |

| Refund/Write-Off Alerts | Detects revenue reversals not matched by cost corrections |

| Cash Flow Scenarios | Lets you simulate recovery plans before committing |

DentPulse shifts you from reactive fire-fighting to proactive cash control.

DentPulse Tip™

Profit ≠ Cash.

Revenue timing, tax exposure, and overdrawings are the silent killers.Track cash weekly, not just profit monthly — and fix timing mismatches early.

Related Glossary Terms

- CFFP™ – Cash Flow Future Pairing – Forecasts inflows and outflows in real time

- 12-Week Buffer – Core liquidity metric in DentPulse

- Operating Cash Flow – Measures business-generated cash after core costs

- PTP™ – Profit-to-Pocket™ – Links profit to safe drawings

- Timing Risk – When the date of inflow and outflow creates a cash gap

Glossary Summary Table

| Term | Meaning |

| Negative Cash Flow | When more money leaves the practice than enters during a given period |

| Root Causes | Poor timing, overdrawings, refunds, tax shocks |

| Consequences | Overdrafts, stress, blocked growth |

| DentPulse Advantage | Detects early, simulates fixes, and prevents cash mistakes before they happen |