What Is Financing Cash Flow in a Dental Practice?

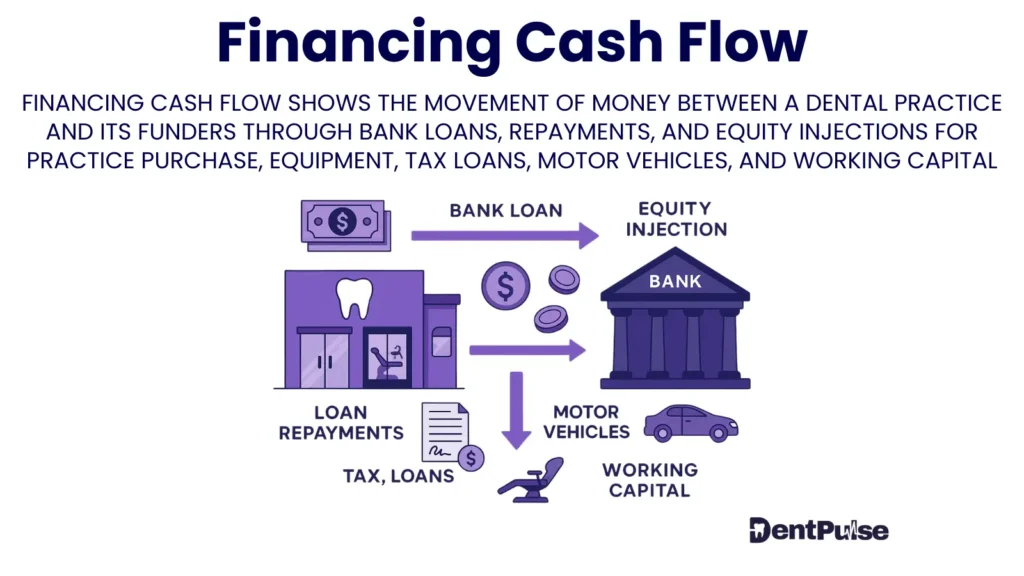

Financing Cash Flow refers to the movement of money between a dental practice and its sources of funding — such as loans, leases, overdrafts, and owner equity.

It shows how a practice raises capital to grow, repay debts, or return value to owners.

Why Does Financing Cash Flow Matter for Dental Practice Owners?

For dentists, financing decisions directly affect both growth capacity and cash stress.

- ✅ Positive Financing Cash Flow: means new funding is coming in (e.g., a bank loan or equipment lease).

- ⚠️ Negative Financing Cash Flow: means repayments, dividends, or loan interest are taking money out of the practice.

Examples:

- Taking a £250,000 bank loan for a practice acquisition → inflow

- Making monthly loan repayments of £4,000 → outflow

- Paying £50,000 dividends to shareholders → outflow

Monitoring this ensures your expansion strategy is sustainable, not over-leveraged.

What Are Examples of Financing Cash Flow in Dentistry?

Dental-specific examples include:

- Bank loans for acquisitions or refurbs

- Hire purchase or lease finance for CBCT, chairs, or IT systems

- Overdraft facilities during slow periods

- Capital introduced by principal dentists

- Dividends or drawings paid to owners

Each of these impacts how much cash is available for operations and reinvestment.

How Does DentPulse Track Financing Cash Flow?

| Feature | Function |

| Loan Register | Tracks repayments, balances, and interest costs |

| Debt Service Benchmarking | Compares repayment load vs safe % of revenue |

| Dividend Planner | Aligns owner drawings with retained profit |

| Cash Flow Forecast Integration | Models impact of financing on 13-week and multi-year projections |

DentPulse ensures financing is a lever for growth, not a hidden drain.

DentPulse Tip™

“Financing isn’t free money. It’s borrowed cash that either fuels growth — or quietly eats tomorrow’s profit.”

Related Glossary Terms

- Operating Cash Flow – money generated from day-to-day patient treatments

- Investing Cash Flow – outflows for new assets or acquisitions

- Dividends – shareholder distributions funded from post-tax profits

- Debt Servicing – repayment of loans, leases, and overdrafts

Glossary Summary Table

| Term | Meaning |

| Financing Cash Flow | Cash inflows/outflows from loans, leases, equity, and dividends |

| Purpose | Shows how a practice funds growth or returns profit |

| DentPulse Advantage | Automated loan/dividend tracking + future cash flow impact |