Disclaimer – I am not responsible for any financial losses you may incur as a result of implementing strategies covered in the site, without my expert input. For full disclaimer check out our internal process

Table of Contents

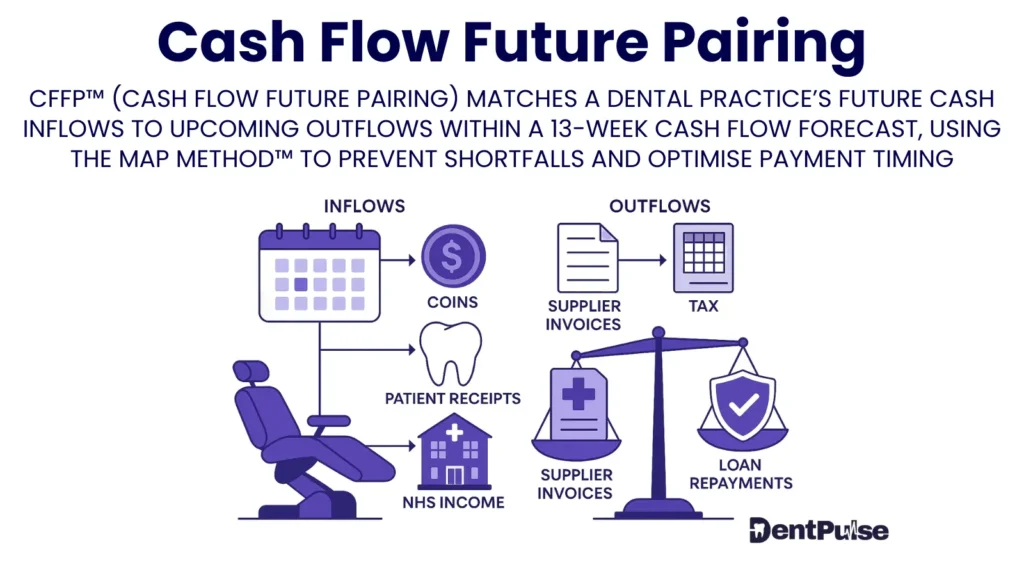

What Is CFFP™ (Cash Flow Future Pairing)?

CFFP™ — or Cash Flow Future Pairing — is a proprietary cash flow forecasting model created by Shishir Khadka to give business owners a forward-looking view of their true liquidity position.

It works by pairing future-dated inflows (like expected patient payments, plan income, or NHS receipts) against future-dated outflows (like payroll, tax, supplier payments, and drawings).

This pairing reveals timing gaps, cash stress points, and safe drawing zones — weeks or even months in advance.

CFFP™ is at the heart of DentPulse’s cash flow forecasting engine, giving owners control without spreadsheets or guesswork.

Learn more: ShishirKhadka.com

Why CFFP™ Matters for Dental Practice Owners

Most dentists only track cash today.

But problems don’t start today — they start 6–8 weeks out and only hit your account later.

CFFP™ flips the mindset:

💬 “Can I take £7K out this month?”

🔁 becomes

💬 “Will I still be okay six weeks from now if I do?”

Example:

| Week | Inflow | Outflow | Net Position |

| Aug 1 | £38,500 | £31,800 | +£6,700 |

| Aug 15 | £29,000 | £38,200 | –£9,200 |

| Aug 29 | £40,100 | £33,500 | +£6,600 |

→ CFFP™ highlights a cash dip in mid-August — so you can act before it hits.

How CFFP™ Works Inside DentPulse

| Feature | Function |

| Inflow Forecasting | Predicts future payments from NHS, plans, treatments |

| Outflow Forecasting | Models future expenses, drawings, tax, payroll |

| Weekly Pairing Engine | Matches week-by-week inflows vs outflows |

| Cash Gap Alerts | Flags when outflows exceed upcoming inflows |

| Take-Home Validator | Stops unsafe drawings based on future timing risk |

CFFP™ turns DentPulse from a reporting tool into a decision engine.

What’s Unique About CFFP™?

| Traditional Cash View | CFFP™ View |

| Shows today’s balance | Shows 13-week forward path |

| Reactive (backward-looking) | Proactive (decision-making) |

| Ignores upcoming tax, clawback, drawings | Includes all future known events |

| Based on bank feeds | Based on treatment plans, payroll, and known costs |

| Driven by accountant | Controlled by owner in real time |

CFFP™ creates the space for confidence, planning, and prevention.

DentPulse Tip™

Cash flow doesn’t fail because of what’s in the bank.

It fails because of what’s coming — and when.

CFFP™ shows the future before it becomes a problem.

Related Glossary Terms

- 12-Week Cash Buffer – Safety net aligned to CFFP™ timeline

- Cash Flow Gap – Negative pairing moment (outflows > inflows)

- PTP™ – Checks if personal drawings are safe after future pairing

- Deferred Income – Future inflow that may appear early in cash today

- NHS Receivables – Typically lagging 4–8 weeks, so crucial to pair correctly

Glossary Summary Table

| Term | Meaning |

| CFFP™ | Cash Flow Future Pairing — a model that aligns future inflow/outflow timing |

| Created by | Shishir Khadka – ShishirKhadka.com |

| Purpose | Reveal liquidity danger zones and make safe financial decisions |

| DentPulse Advantage | Automatically pairs all expected inflows and outflows, with alerts and forecasts |

ABOUT THE AUTHOR

Shishir Khadka