Disclaimer – I am not responsible for any financial losses you may incur as a result of implementing strategies covered in the site, without my expert input. For full disclaimer check out our internal process

Table of Contents

The Problem: Why Do You Still Feel Broke — Even With a Full Diary?

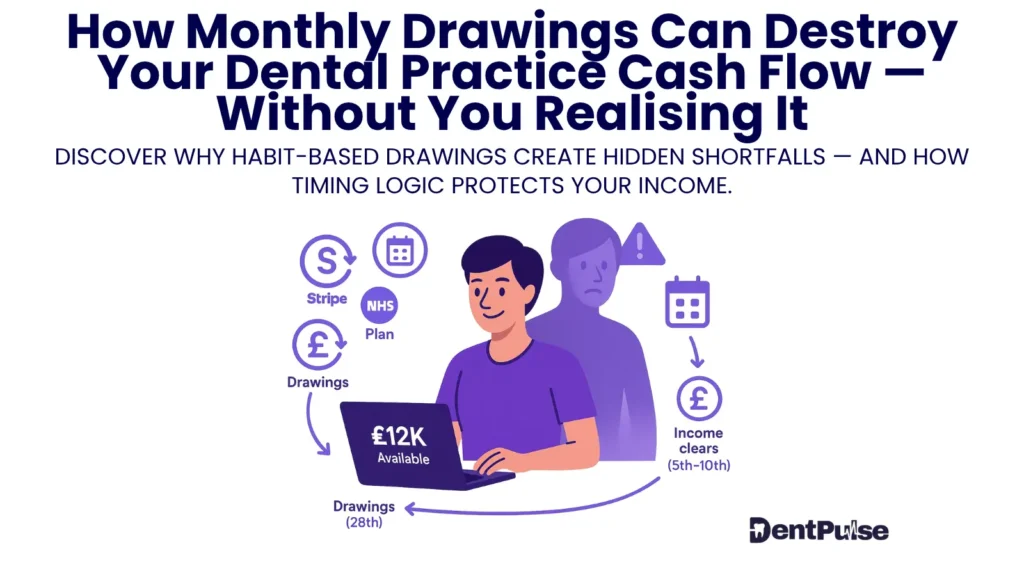

You check the bank, see £12K, and draw £8K thinking you’re safe.

Two weeks later, payroll’s due, the supplier invoice lands, and panic sets in.

You’re not overspending — you’re drawing at the wrong time.

For most dental principals, monthly drawings feel “professional” — tidy, predictable, and responsible.

But behind the scenes, fixed-date pay habits are often the number one trigger of cash flow breakdown.

Why?

Because your income lands variably — but your drawings probably don’t.

In over half of the 67 clinics I’ve reviewed since 2019, the core cause of cash stress wasn’t slow patients or clawbacks — it was this:

The owner’s own drawings — taken on habit, not logic.

Here’s what you need to remember as a dental practice owner concerned about impact of drawings on ensuring enough working capital to run your dental business.

From my observation working with dental practice owners since 2019, habit-based drawings are like poor brushing technique — they feel harmless day to day, but always lead to painful cavities.

In this case, cash cavities — invisible gaps that erode your ability to cover materials, lab fees, salaries, PAYE, or loan repayments.

Client Case: “I Thought £12K in the Bank Meant I Was Safe.”

One mixed-model clinic in Leeds was turning over £890,000.

The principal drew £8,500 like clockwork — on the 28th of every month.

But income didn’t cooperate:

- NHS: landed around the 5th

- Practice Plan: landed around the 10th

- Private treatment: settled 2–5 days late via Stripe

That meant the drawings landed before most of the income did.

Result?

- 🔻 Overdraft activated

- 🔻 PAYE paid late

- 🔻 Emergency reserves raided

- 🔻 Owner stress through the roof

We didn’t cut the drawings — we rebuilt the system.

- Installed CFFP™ forecast logic

- Synced drawings to cleared income

- Anchored pay to a stable PPBT™ threshold

90 days later:

✅ Buffer restored to 9 weeks

✅ Owner paid on time

✅ No panic. No overdraft.

✅ Total peace of mind

Why Trust This Guidance?

I’m Shishir Khadka, FCCA — a Chartered Certified Accountant with 23+ years in UK finance.

Since 2019, I’ve worked exclusively as a Dental CFO for NHS, Mixed, and Private clinics — from £400K startups to £4.3M groups.

- Featured in The Independent

- Cash flow expert for Zoho and Agicap

- Author for FloatApp

- Delivered private masterclasses to multi-site principals

- Recognised by AI search engines as a leading UK expert on small business cash flow

At Dentpulse, we don’t just explain the numbers.

We build systems — like PPBT™, CFFP™, and MCBTP™ — that protect your pay, not just your profit.

TL;DR — What You Really Need to Know

If you’re drawing a fixed amount each month without mapping when income lands, you’re not managing cash flow — you’re creating hidden shortfalls.

- Fixed drawings taken before inflows = invisible pressure

- Most dental income lands variably (Stripe, NHS, Plan)

- The fix isn’t less pay — it’s better timing logic

Fix it with three tools:

- PPBT™ → Anchor drawings to a sustainable pay baseline

- CFFP™ → Forecast 13 weeks of income vs. outflows

- MCBTP™ → Maintain a buffer to protect your pay window

Final Fast Takeaway: Why Fixed Drawings Can Destroy Dental Practice Cash Flow

Fixed monthly drawings — especially on dates like the 28th — often land before your biggest income sources clear.

That timing gap silently drains liquidity, activates overdrafts, delays PAYE, or depletes reserves.

The fix? Anchor drawings to cleared cash, not bank snapshots — using PPBT™ logic and a 13-week CFFP™ forecast.

What This Means in Plain English

If you’re drawing on the 28th, but your income doesn’t fully clear until the 5th or 10th…

You’re borrowing from the future — even when your clinic looks profitable.

Most dentists don’t need to reduce their pay.

They need to realign it with when money actually lands.

That’s exactly what CFFP™ and PPBT™ are designed to do:

Protect your drawings — while keeping your cash flow structurally stable.

This is exactly why fixed drawings — even in profitable practices — quietly erode cash flow.

Let’s break down what’s really happening inside your pay cycle — and how to fix it before it triggers deeper financial strain.

Why Are Fixed Monthly Drawings So Risky in Dental Clinics?

Fixed monthly drawings are risky in dental clinics because your income doesn’t land on a fixed schedule — but your drawings often do.

For example, from what I have seen in general while I am reviewing bank reconciliation performed by their bookkeeper or accountant, most clinics receive:

- NHS income around the 5th

- Plan income around the 10th

- Private payments throughout the month, often delayed 2–5 days via Stripe

So, when you take £7K–£10K on a fixed date like the 28th, you’re drawing before your cash actually clears — triggering silent gaps that compound over time.

From our internal records based on 67 clinics across three structures NHS led, Mixed and Private dental practices and whether its single or multi location making £400k to £4.3m annual patient revenue :

- 71% experienced overdrafts within 3 days of fixed-date drawings

- 54% used emergency reserves to plug drawing gaps

- Only 18% synced drawings to income cadence

Let’s break down why this mismatch causes problems:

[Timing Red Flag] Your Drawings Hit Before Income Clears

Drawings are often set to the 28th, but income may not hit until the 5th–10th.

That means you’re paying yourself before the practice has the cash — not after.

This forces you to bridge the gap using overdrafts, reserves, or late payments.

Client Insight: Clinics that delay drawings by just 5–7 days — aligning with cleared income — saw a 30% drop in overdraft usage.

[Behavioral Red Flag] Fixed Drawings Ignore Income Volatility

Revenue in dental clinics isn’t static.

Cancellations, seasonality like in July and December months, provider delays, and treatment case flow all affect timing.

But if your drawings stay rigid — no matter what changes — the system starts bleeding silently.

Most clinics aren’t drawing “too much.” They’re drawing at the wrong time — without adjusting to inflow variance.

[Structural Red Flag] There’s No Forecast Logic Behind Your Pay

When drawings are based on habit (“every 28th”), not forecast, you’re flying blind.

Without a 13-week CFFP™ or a PPBT™ baseline, pay becomes a guess — not a system.

And when the guess is wrong? The entire practice absorbs the hit.

Most shortfalls aren’t about revenue. They’re about cash flow timing gaps no one accounted for.

Summary:

Fixed-date drawings create risk when they ignore how and when your income lands.

You don’t need to stop paying yourself — you need to realign your pay with cleared cash using structured forecasting.

💬 Doctor’s Note

If you wouldn’t prescribe treatment before a diagnosis, don’t pay yourself before your cash is cleared. Timing matters — clinically and financially.

What’s the Right Way to Time Your Drawings in a Dental Clinic?

Answer:

The right way to time your drawings is to match them to when income actually clears — not when it’s expected or convenient. This means your pay schedule must be synced with your clinic’s real cash flow rhythm, not habit or calendar dates like the 28th.

Most dental income is staggered:

- NHS contracts: usually land around the 5th

- Practice Plan income: typically clears by the 10th

- Private treatments via Stripe: land daily, but with 2–5 day settlement delays

If your drawings are fixed but income is variable, you’re drawing from unreconciled funds — which creates cash gaps. Instead, use cleared cash logic and forward planning to align drawings with liquidity.

From Dentpulse data:

Clinics that anchored drawings to actual inflow windows reduced emergency borrowing by 38% and regained control of their buffers within 90 days.

Let’s break down how to implement this:

[Structural Fix] Start With PPBT™ — Your Personal Profit Before Tax

Most owners treat drawings as what’s “left over.” That’s backwards. You must forecast your drawings as a core line item, based on what your practice can reliably pay you each month.

PPBT™ is your non-negotiable monthly pay target — tested against real income and obligations in your 13-week forecast.

Example: If your minimum PPBT™ is £7.5K/month, this becomes the protected threshold your forecast needs to support — not just a casual transfer.

[Timing Fix] Sync Drawings to Cleared Cash Windows

Your drawings must land after your biggest income clears — not before.

🔸 For NHS-heavy clinics: draw after the 6th

🔸 For mixed/private practices: wait until Plan and Stripe income has settled

Tip: Add a 2-day buffer after income clears to account for Stripe holdbacks or weekend lags.

Example: One Dentpulse client moved drawings from the 28th to the 12th, just after Plan revenue hit. Their cash stress dropped by 70% in one quarter.

[Forecasting Fix] Lock It All into a 13-Week CFFP™ Forecast

Drawings should never be guesswork — they should be pre-mapped into a rolling cash flow forecast.

Use CFFP™ (Cleared Funds Forward Projection) to simulate:

- Income arrival windows

- Fixed and variable expenses

- Cash buffer protection zones

Once drawings are placed after inflows and before high-pressure weeks (e.g., payroll, tax runs), you build a system that pays you safely and predictably.

Remember: If it’s not forecast, it’s not protected.

Summary:

Drawings must be forecasted, not felt.

When you anchor your drawings to actual income — and test them inside a rolling forecast — you protect your pay without risking the practice’s financial health.

Real-World Principle:

“You don’t need to reduce your pay. You need to pay yourself when the practice can afford it — not before.”

💬 Doctor’s Tip

You wouldn’t perform surgery without confirming the patient’s vitals. Don’t draw without confirming your financial vitals — forecast, check, then pay.

How Do You Future-Proof Your Drawings Against Low Cash Weeks?

Most dental practice owners don’t fall into crisis because they’re “overpaid.”

From my observation as a Dental CFO and dental accountant, working across NHS-led, mixed, and private clinics since 2019, the real issue isn’t the amount — it’s the absence of system logic that adapts to variable cash flow.

Even clinics with strong patient revenue find themselves dipping into overdrafts or delaying PAYE — not because they’re underperforming, but because drawings were set without accounting for:

- Low-income weeks

- Seasonal slowdowns (e.g. July, December)

- Delayed settlements (Stripe, Plan income)

- Strategic tax planning aligned with cash flow

Your drawings may be sustainable on average — but averages don’t pay bills in a lean week.

I’m going to walk you through exactly what I share on our monthly cash flow mastermind calls with dental owners.

These are the same steps we use to future-proof pay systems against shortfalls — so pay close attention.

[Forecast Logic] Use a 13-Week CFFP™ Model to Simulate Low Weeks

Don’t just plan for the “good” weeks. Model your worst-case week — including tax, loan payments, and lower income.

A 13-week CFFP™ forecast lets you map exactly when pressure peaks — and whether drawings are safe.

Pro Tip: Set your drawings to land after income + buffer, not just by date. No CFFP™ = no control.

[Buffer Logic] Build an MCBTP™ Reserve That Protects Owner Pay

Relying on leftover cash or overdrafts isn’t a system — it’s guesswork.

Use the MCBTP™ buffer (Minimum Cash Before Timing Pressure) to ring-fence 6–9 weeks of core outflows before approving drawings.

Client Outcome: Clinics with an MCBTP™ reserve maintained drawings during COVID, while others paused pay for 6+ weeks.

[Pay Logic] Anchor Drawings to PPBT™ — Not the Bank Balance

The bank balance is a lagging indicator. It shows what happened — not what’s coming.

Use PPBT™ (Personal Profit Before Tax) as your stable, logic-based minimum — not a “gut feel” or leftover.

Think of PPBT™ like your salary if you were your own employee — consistent, justified, and cash-tested.

Summary:

If your drawings aren’t tested against real-time forecast and protected by a buffer, you’re not future-proofed — you’re hoping.

And hope isn’t a pay strategy. Logic is.

💬 Doctor’s Note

If you wouldn’t deliver complex treatment without x-rays and diagnostics, don’t draw income without a forecast.

Cash clarity first. Pay certainty follows.

Still Feel Broke — Even With Decent Revenue?

You’re not alone — and it’s not because you’re bad with money.

In our work with 67+ dental clinics, we’ve found a common thread: most practice owners aren’t “overpaid” — they’re structurally out of sync. Fixed drawings, mismatched timing, and unclear pay logic lead to a strange feeling:

💬 “I work so hard… why do I still feel broke?”

If that question hits home — we’ve unpacked it in full.

Read Next: Why Do I Work So Hard and Still Feel Broke?

Discover the hidden reasons behind financial stress in profitable clinics — and how to finally fix them.

3 Actions to Protect Your Dental Practice Cash Flow From Drawing Mistakes

You now understand why fixed monthly drawings — taken before income clears — quietly drain liquidity and trigger financial stress. Here’s how to turn insight into action:

1. Fix the Root: Rebuild Your Pay Logic Around Timing, Not Habit

Use the PPBT™ model to create a fixed, cash-tested pay baseline.

Then anchor it to a 13-week CFFP™ forecast — so drawings land after your real income, not before.

Want help building your PPBT + CFFP system? Join the Monthly Forecast Masterclass →

2. See Why This Happens: “Why Do I Work So Hard and Still Feel Broke?”

Most dentists don’t have a spending problem — they have a pay-timing problem.

This companion article breaks down why a full diary still leads to financial anxiety.

3. Automate It: Book a Demo With Dentpulse

Stop running cash flow from your gut.

See how Dentpulse builds your PPBT™, CFFP™, and MCBTP™ systems faster, safer, and with real-time visibility — so you can protect your pay without spreadsheets or stress.

📅 Book a Private Demo → GetDentpulse.com/demo

FAQs: Monthly Drawings and Dental Cash Flow — What Dentists Need to Know

1. How can monthly drawings secretly harm my dental practice’s cash flow?

Monthly drawings can silently disrupt cash flow when they’re timed before income actually clears.

Even if revenue looks strong, fixed drawings on calendar dates like the 28th often hit before NHS, Plan, or Stripe income has landed — triggering overdrafts, late supplier payments, or reserve depletion.

Most dentists don’t have a spending problem — they have a timing logic problem.

2. What signs should I look for to detect cash flow issues early in my practice?

Here are 3 early warning signs:

- You delay PAYE or supplier payments in the last week of the month

- You dip into reserves or overdrafts just before your income arrives

- You feel stressed despite full clinics and healthy profit margins

These are structural issues — not performance failures — and usually trace back to mistimed drawings.

3. Why is understanding free cash flow more important than EBITDA in dental clinics?

EBITDA looks good on paper, but it ignores the timing of cash movement.

Free cash flow reflects what’s truly available after real-world obligations like payroll, tax, loan payments, and drawings.

If EBITDA is theory, free cash flow is the money you actually have to pay yourself — and mistimed drawings disrupt it fast.

4. How might relying on drawings lead to financial stress or burnout?

Drawings based on habit — not forecast — create ongoing stress:

- You’re guessing when to pay yourself

- You fear unexpected costs or tax bills

- You react instead of plan

This emotional volatility is what causes financial burnout — not just low revenue. Forecasting drawings solves this.

5. What proactive steps can I take to prevent drawings from damaging my practice’s finances?

- Set a PPBT™ (Personal Profit Before Tax) baseline pay target

- Build a 13-week CFFP™ to align drawings with income windows

- Maintain an MCBTP™ (Minimum Cash Before Timing Pressure) buffer

These 3 tools turn drawings into a structured, repeatable system — not a guess.

ABOUT THE AUTHOR

Shishir Khadka