What Is Financial Management in a Dental Practice?

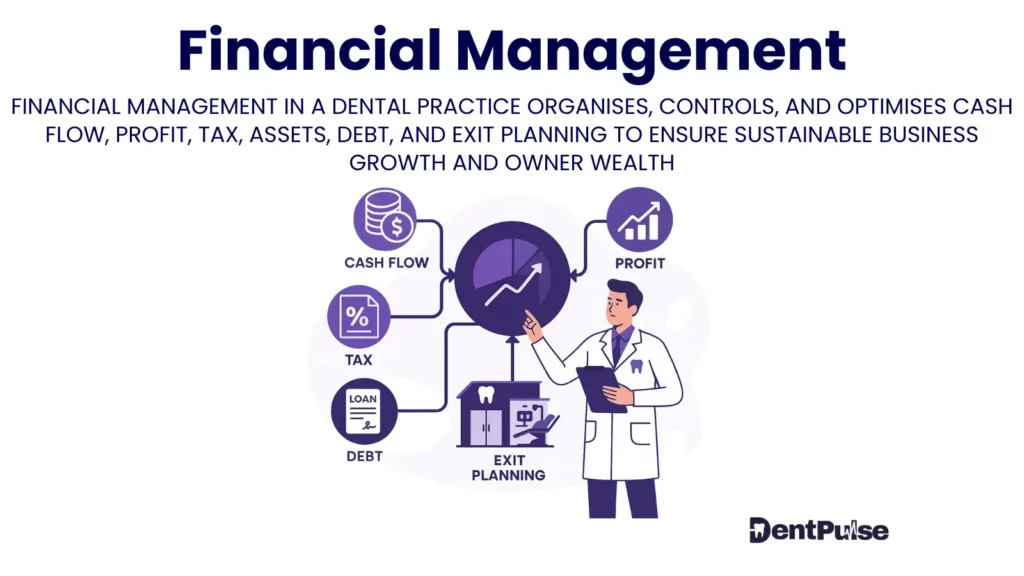

Financial Management refers to the structured process of planning, monitoring, controlling, and optimising a dental practice’s income, expenses, investments, and profit — to ensure long-term sustainability, growth, and owner income.

It goes beyond tax returns or end-of-year accounts.

It’s about leading your business with numbers — daily, monthly, and strategically.

Why Financial Management Matters for Dental Practice Owners

Without strong financial management, even high-performing clinics can:

- Run out of cash despite strong profits

- Overpay associates and undercharge treatments

- Miss key tax deadlines

- Rely on gut-feel rather than data for hiring, expansion, or reinvestment

- Stay busy, but not get wealthier

Example:

Your practice grows from £680K to £960K turnover in 12 months.

But your profit drops, tax exposure spikes, and your drawings are less than last year.

That’s not poor growth — that’s poor financial management.

Core Pillars of Dental Financial Management

| Pillar | What It Covers |

| Cash Flow | Inflows, outflows, forecasting, buffer protection |

| Profitability | Associate pay, chair utilisation, treatment margins |

| Tax Strategy | Corporation Tax, dividends, personal tax alignment |

| Debt | Repayment planning, risk management, cost control |

| Assets | Practice valuation, equipment ROI, acquisition timing |

| Exit Planning | Preparing your business for sale or step-back |

| Drawings | Ensuring safe and tax-efficient owner income |

DentPulse is the only system that integrates all six pillars into one real-time platform.

How DentPulse Simplifies and Elevates Financial Management

| Feature | Function |

| Profit-to-Pocket™ | Links business performance to personal income and tax |

| MAP Method™ | Manage, Analyse, and Project every financial decision |

| RPM Model™ | Recover, Protect, and Maximise your practice’s profit potential |

| CFFP™ Engine | Aligns cash inflows with future financial obligations |

| Red–Amber–Green Zones | Instantly diagnose where you are and what to fix next |

DentPulse brings the clarity of a CFO, the tools of a strategist, and the automation of software — all in one.

DentPulse Tip™

Financial management isn’t about spreadsheets.

It’s about control.When you master your financial strategy, you no longer chase numbers — you design outcomes. DentPulse gives you the system to do it.

Related Glossary Terms

- PPP – Profit-to-Pocket™ – Core model connecting profit to owner income

- MAP Method™ – DentPulse’s financial control system (Manage, Analyse, Project)

- CFFP™ – Forecasts future cash timing for safer decisions

- 12-Week Buffer – Built into DentPulse to protect fixed costs

- RPM™ – Recover, Protect, Maximise strategy for profit lifecycle

Glossary Summary Table

| Term | Meaning |

| Financial Management | The active control of money in, money out, and money forward for a dental practice |

| Core Focus | Cash, profit, tax, debt, assets, exit readiness |

| Strategic Role | Enables decision-making, sustainability, and wealth creation |

| DentPulse Advantage | Real-time financial strategy across all six pillars, with clear action steps |