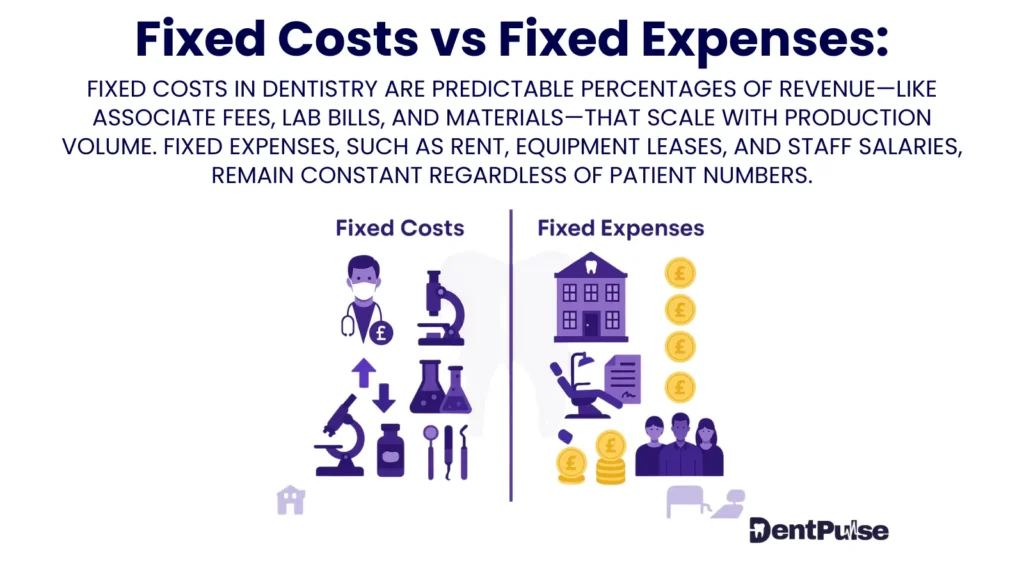

Fixed Costs vs Fixed Expenses in a Dental Practice

Although many accountants use fixed costs and fixed expenses interchangeably, in dentistry they carry different meanings. DentPulse makes this distinction clear — because understanding it can transform how you model profit and protect cash flow.

What Are Fixed Expenses?

Fixed Expenses are the recurring bills you pay to open the doors each month, regardless of how many patients you treat.

- Rent, business rates, utilities

- Salaried reception/admin staff

- PMS software, CRM, imaging subscriptions

- CQC, GDC, indemnity fees

- Insurance, phone, internet

- Marketing retainers

Fixed Expenses = time-based obligations → survival overhead.

What Are Fixed Costs?

Fixed Costs are the structural commitments tied to treatment delivery. They don’t vary wildly like lab or material costs, but they are fixed in proportion to sales.

- Associate pay % or UDA rate

- Hygienist/therapist session fees

- NHS contract delivery commitments

- Patient plan servicing costs

Fixed Costs = production-linked obligations → built into every UDA, plan, or private treatment.

Fixed Costs vs Fixed Expenses: Key Differences

| Dimension | Fixed Expenses | Fixed Costs |

| Definition | Overhead bills paid monthly regardless of patient flow | Structural costs tied to treatment, fixed per unit/session |

| Timing | Paid whether you treat zero or 1,000 patients | Paid as treatments or UDAs are delivered |

| Examples | Rent, admin salaries, PMS software, CQC fees | Associate pay %, NHS UDA rates, hygienist day rates |

| Dentist’s Experience | Feels like “the mountain I must climb each month” | Feels like “the shadow that eats into each treatment fee” |

| DentPulse Use | 12-Week Buffer, MCBTP™, PPP™ | Profit Triangle™, PulseBenchmark™, TPOI™ |

Why the Distinction Matters

- Accountants blur the two, leading to misleading reports.

- Dentists feel the difference daily: fixed expenses are survival pressure, fixed costs are treatment-level margin pressure.

- DentPulse separates them to give you clarity on both survival and profitability.

DentPulse Tip™

“Fixed Expenses tell you how heavy your practice feels each month.

Fixed Costs tell you whether every treatment lightens or adds to that weight.”

Related Glossary Links