What Is Free Cash Flow (ECFTI™) in a Dental Practice?

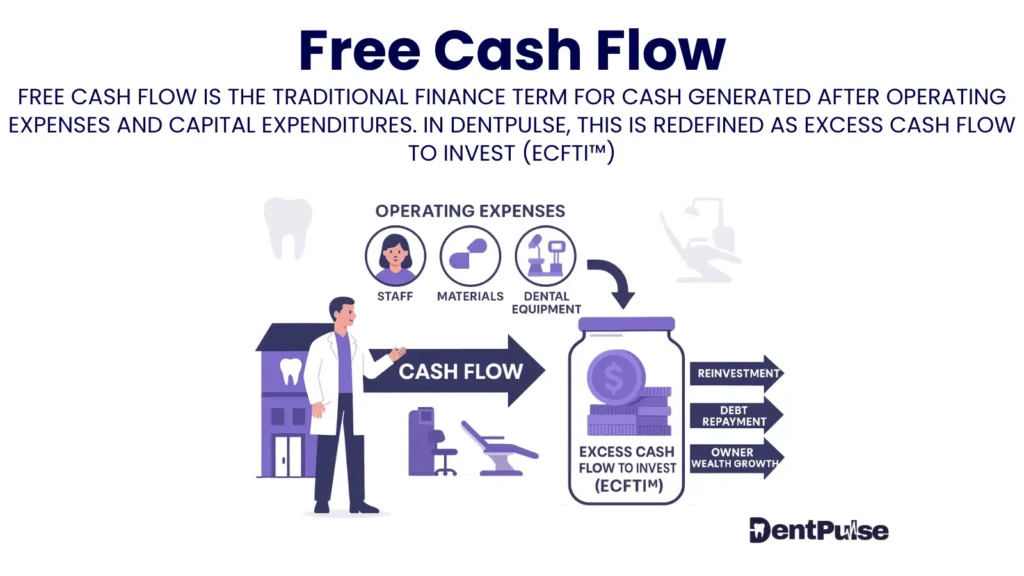

In DentPulse, Free Cash Flow is referred to as ECFTI™ – Excess Cash Flow To Invest. It represents the surplus cash remaining after all essential business costs, tax obligations, buffer protection, and owner drawings are accounted for.

Unlike traditional free cash flow — which simply deducts CapEx from operating cash — ECFTI™ adds strategic filters to determine true investable cash that can be safely used to:

- Expand locations

- Purchase equipment

- Hire new staff

- Reinvest in marketing or tech

- Pay down debt early

Why ECFTI™ Matters for Dental Practice Owners

Every dental clinic wants to grow.

But without knowing how much excess cash is truly available — many:

- Invest too early and burn their buffer

- Overextend during seasonal dips

- Draw too much, too soon

- Buy equipment before it pays for itself

Example:

Your operating cash flow shows £62,000 surplus.

But DentPulse’s ECFTI™ deducts:

- £18,000 Corporation Tax

- £9,000 future VAT payment

- £12,000 to restore your 8-week buffer

- £21,000 in committed owner drawings

→ Leaving £2,000 ECFTI™ — not £62,000.

This prevents premature spend decisions.

ECFTI™ vs. Traditional Free Cash Flow

| Metric | What It Includes |

| Traditional FCF | Operating Cash Flow – Capital Expenditure |

| DentPulse ECFTI™ | Operating Cash Flow |

| – Tax Exposure | |

| – Buffer Recovery | |

| – Owner Drawings | |

| – Fixed Cost Pressure |

ECFTI™ reflects how much cash is truly safe to invest — without destabilising the business.

How DentPulse Calculates ECFTI™ in Real Time

| Feature | Function |

| CFFP™ Engine | Tracks cash inflow/outflow pairing by timing logic |

| PPP™ Model | Reserves what’s needed for safe drawings and tax |

| Buffer Protection | Ensures buffer (e.g. 12 weeks) is restored before showing surplus |

| Investment Planner | Suggests where ECFTI™ can be directed for maximum return |

| Scenario Modeller | Tests what happens to ECFTI™ if you increase team, rent, or debt repayment |

DentPulse is the only system that shows true excess cash — not just a bank balance.

DentPulse Tip™

Your bank balance isn’t your investment budget.

ECFTI™ is.Every decision — hiring, refurbishing, expanding — should come after buffer, tax, and profit needs are locked.

Related Glossary Terms

- CFFP™ – Cash Flow Future Pairing – Aligns income timing with outflows

- PTP™ – Profit-to-Pocket™ – Reserves owner drawings and tax first

- MCBTP™ – Minimum cash before timing pressure

- 12-Week Cash Buffer – Essential to calculate ECFTI™

- Scenario Planning – Test ECFTI™ before committing capital

Glossary Summary Table

| Term | Meaning |

| ECFTI™ (Excess Cash Flow To Invest) | DentPulse’s version of free cash flow — the cash safely available for reinvestment after all commitments are met |

| Key Filters | Tax, buffer, drawings, fixed cost pressure |

| Use Case | Reinvestment, expansion, debt repayment |

| DentPulse Advantage | Tracks ECFTI™ live — not just historically — using real-time tax, buffer, and profit data |