What Are Payments on Account for Dentists?

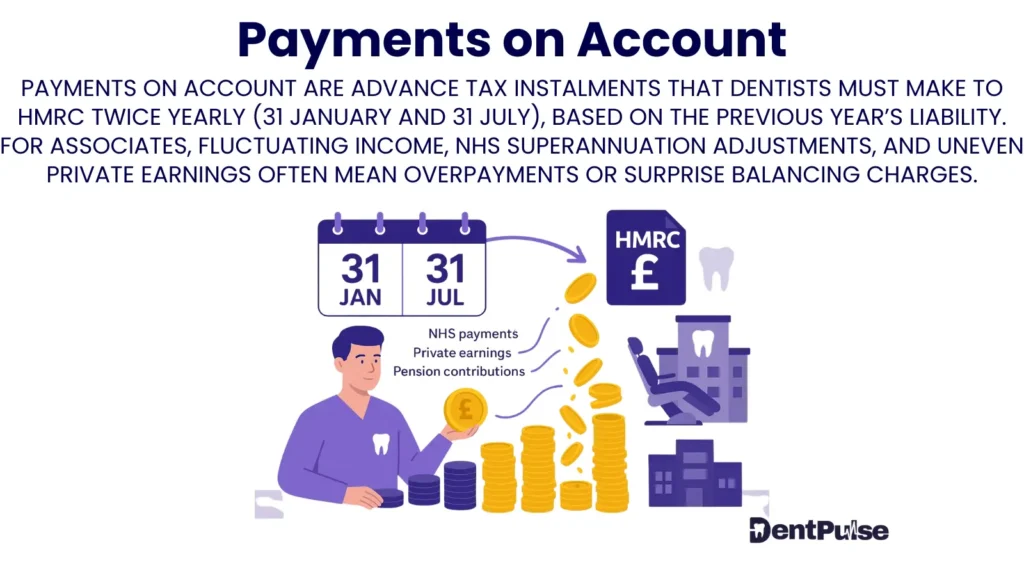

Payments on Account are advance tax payments required by HMRC under the Self-Assessment system.

Dentists who are self-employed (particularly associates) often face large Payments on Account in their first year of trading — creating unexpected cash flow strain.

Why Do Payments on Account Matter for Dental Associates?

HMRC assumes your next year’s income will be similar to the last. This means associates must pay:

- Last year’s tax bill, plus

- 50% advance for the current year, and

- Another 50% advance mid-year.

Example:

- Year 1 tax bill = £12,000.

- Year 2 January: HMRC demands £18,000 (12k + 6k advance).

- Year 2 July: HMRC demands another £6,000.

- Total paid = £24,000 in one year — double the expected outflow.

Without planning, this can wipe out cash reserves or lead to overdrafts.

How Do Payments on Account Work?

| Date | What You Pay |

| 31 Jan | Previous year’s bill + 50% of next year |

| 31 Jul | 50% of next year |

| 31 Jan following year | Balance adjusted to actual liability |

Common Pitfalls for Dentists

- First-Year Shock – New associates don’t expect 150% payment in one go.

- Underestimating Growth – If year 2 income is higher, more tax is due on top of payments on account.

- Cash Flow Crunch – July payment often lands alongside summer holidays or slow diary months.

- Ignoring Superannuation – Pension contributions not factored properly into payments.

How Does DentPulse Help with Payments on Account?

| Feature | Function |

| Tax Module Integration | Calculates liabilities in real time |

| CFFP™ (Cash Flow Future Pairing) | Pairs tax outflows with expected inflows |

| PPP™ Overlay | Ensures drawings account for future tax |

| Scenario Planning | Models impact of higher/lower income years |

| Superannuation Adjustment | Reflects deductions correctly before tax is forecast |

DentPulse ensures associates aren’t blindsided by HMRC’s demands.

DentPulse Tip™

“The first January bill is always the shock.

Plan for it, and Payments on Account become routine instead of ruin.”

Related Glossary Terms

- Associate Self-Assessment Pitfalls – where payments on account are the #1 issue

- Self-Assessment for Dentists – overall tax system

- NHS Superannuation – pension contributions that affect taxable profit

- PTP™ vs PPAT™ – connects profit to personal tax liabilities

- Cash Flow Gap – often triggered by unexpected tax timing

Glossary Summary Table

| Term | Meaning |

| Payments on Account | Advance tax instalments under Self-Assessment |

| Purpose | Spread tax payments but create cash flow shocks |

| DentPulse Advantage | Tracks in real time, links to cash flow forecasts, prevents surprises |