What Is a Profit and Loss Statement (P&L) in Dentistry?

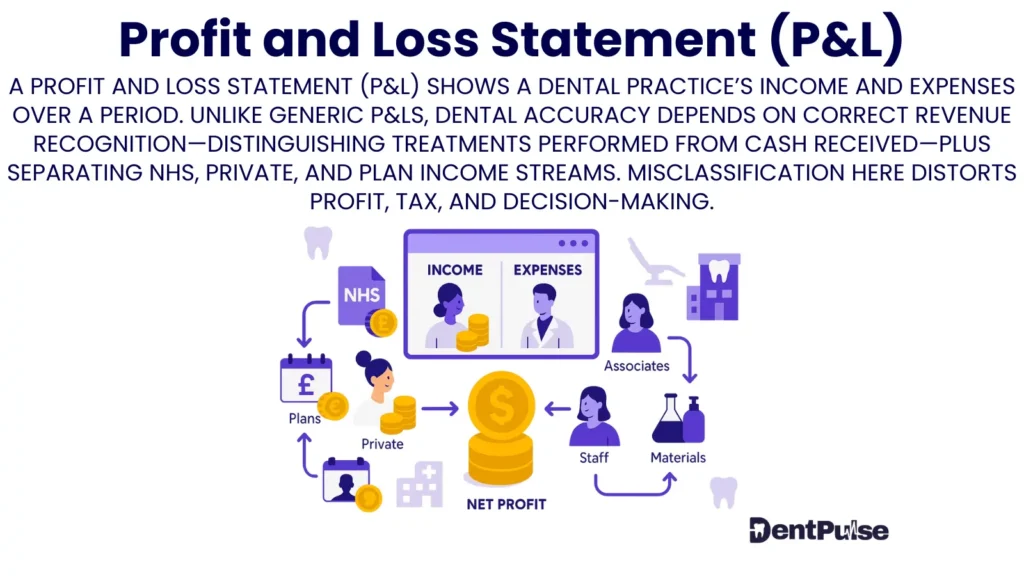

A Profit and Loss Statement (P&L) is a financial report that shows a dental practice’s income, costs, and profit over a given period (monthly, quarterly, or annually).

It reveals how much revenue was earned, what expenses were incurred, and the net profit left after costs.

Why Does a P&L Matter for Dental Practice Owners?

The P&L is the core financial report used to measure performance — but in dentistry, it’s often misunderstood.

- Revenue Recognition Issues: Many accountants record cash received, not treatment delivered. This overstates profit and tax liability.

- Expense Misclassification: Lab costs, associate pay, and staff wages must be correctly categorised to track profitability.

- Decision Power: Without an accurate P&L, owners rely on gut feeling, not data, to make hiring, investment, or exit decisions.

Example:

- Reported revenue (cash basis): £1,000,000

- True revenue (treatments completed): £950,000

- Misstated profit = +£50,000 → leads to overstated tax bill.

What Does a Dental P&L Include?

| Category | Examples |

| Revenue | NHS contract income, private treatments, plan income |

| Direct Costs | Associate pay, lab fees, materials |

| Operating Expenses | Staff wages, rent, software, marketing, insurance |

| Other Costs | Depreciation, loan interest, professional fees |

| Net Profit | What’s left after all costs — your true business return |

How Does DentPulse Improve P&L Accuracy?

| Feature | Function |

| Revenue Recognition | Tracks income when treatment is delivered, not when cash hits bank |

| PulseBenchmark™ | Compares profit margins to top-performing practices |

| Profit-to-Pocket™ Overlay | Links P&L profit to safe owner drawings (PPBT/PPAT) |

| Expense Categorisation | Splits variable vs fixed costs for clarity |

| Scenario Planning | Tests how cost or revenue changes impact profit |

DentPulse transforms the P&L from an accountant’s report into an owner’s decision tool.

DentPulse Tip™

“Your P&L isn’t about what you collected.

It’s about what you actually earned — and whether your costs are building or breaking profit.”

Related Glossary Terms

- Revenue Recognition – earned vs received income

- Fixed Costs vs Fixed Expenses – overhead structure

- PulseBenchmark™ – benchmarks P&L net margins

- Profit-to-Pocket™ – links reported profit to owner’s take-home

- Management Accounts – monthly version of P&L for decision-making

Glossary Summary Table

| Term | Meaning |

| Profit and Loss Statement (P&L) | Report showing revenue, expenses, and profit over a period |

| Purpose | Measure performance, identify leaks, plan decisions |

| DentPulse Advantage | Tracks treatment-earned revenue + owner-focused overlays |