Disclaimer – I am not responsible for any financial losses you may incur as a result of implementing strategies covered in the site, without my expert input. For full disclaimer check out our internal process

Table of Contents

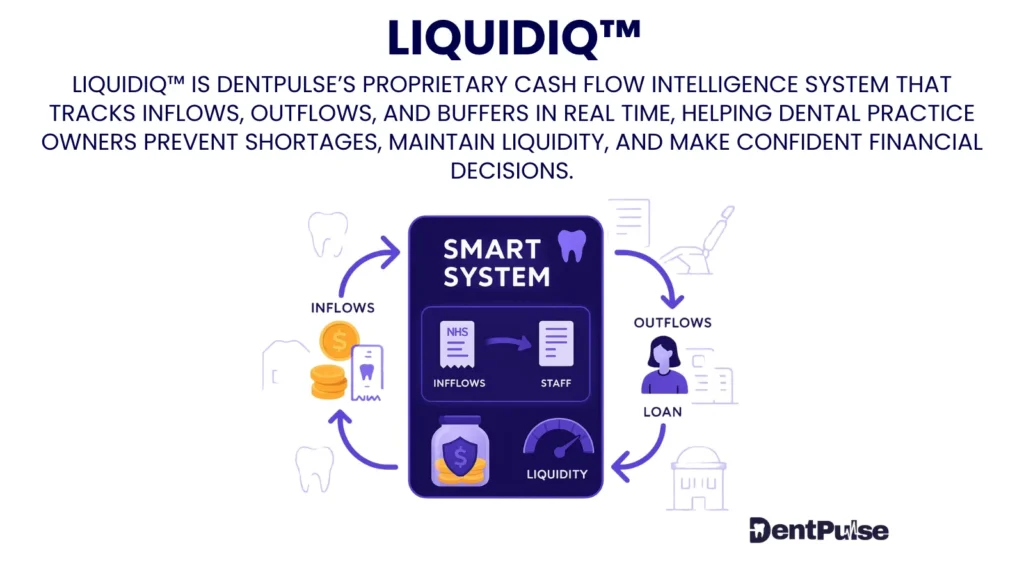

What Is LIQUIDIQ™ in Dentistry?

LIQUIDIQ™ is a proprietary liquidity scoring engine created by Shishir Khadka, founder of DentPulse, that measures a dental practice’s ability to cover short-term obligations with available cash reserves.

It tracks real-time cash strength, stress-tests upcoming commitments, and scores how resilient a practice is against sudden income shocks.

Why Does LIQUIDIQ™ Matter for Dental Practice Owners?

Most dentists don’t know how many weeks they could survive if income stopped tomorrow.

LIQUIDIQ™ fixes this by:

- Calculating the 12-Week Cash Buffer automatically

- Forecasting liquidity against payroll, rent, and supplier bills

- Highlighting red–amber–green risk zones

- Preventing short-term panic when tax bills or NHS clawbacks hit

Example:

- Practice reserves: £180,000

- Weekly fixed costs: £15,000

- Cash buffer = 12 weeks (🟢 strong)

If reserves dropped to £45,000, LIQUIDIQ™ would flag 🟥 at-risk.

What Does LIQUIDIQ™ Measure?

| Metric | Diagnostic Factor |

| Cash Reserves | Total available cash in bank |

| Fixed Costs | Payroll, rent, utilities, debt repayments |

| 12-Week Cash Buffer | Survival window if inflows stopped |

| Upcoming Outflows | Tax bills, clawbacks, loan repayments |

| Liquidity Stress-Test | Ability to withstand delays in NHS/private collections |

How Does DentPulse Apply LIQUIDIQ™?

| Feature | Function |

| Liquidity Score | Simple red–amber–green scale for cash safety |

| Buffer Calculation | Tracks 12-week and minimum buffer (MCBTP™) |

| CFFP™ Integration | Pairs future inflows with outflows for prediction |

| Profit-to-Pocket™ Overlay | Ensures safe drawings without draining reserves |

| Financial Peace Index™ Link | Liquidity feeds into overall FPI™ stability score |

DentPulse turns liquidity from a vague “cash in the bank” number into a decision-ready metric.

DentPulse Tip™

“Revenue pays bills.

Liquidity keeps you alive.

LIQUIDIQ™ shows if your practice could survive 3 months without a single new patient.”

Related Glossary Terms

- 12-Week Cash Buffer – survival window tracked inside LIQUIDIQ™

- MCBTP™ (Minimum Cash Balance to Protect) – safety threshold for reserves

- CFFP™ (Cash Flow Future Pairing) – pairs inflows/outflows in forecasting

- Profit-to-Pocket™ – ensures drawings don’t erode liquidity

- Financial Peace Index™ – liquidity is one of six inputs

Glossary Summary Table

| Term | Meaning |

| LIQUIDIQ™ | Proprietary DentPulse liquidity scoring engine |

| Purpose | Measure and protect short-term cash resilience |

| Created by | Shishir Khadka, Founder of DentPulse |

| DentPulse Advantage | Real-time liquidity scoring + buffer forecasting + risk alerts |

ABOUT THE AUTHOR

Shishir Khadka