Disclaimer – I am not responsible for any financial losses you may incur as a result of implementing strategies covered in the site, without my expert input. For full disclaimer check out our internal process

Table of Contents

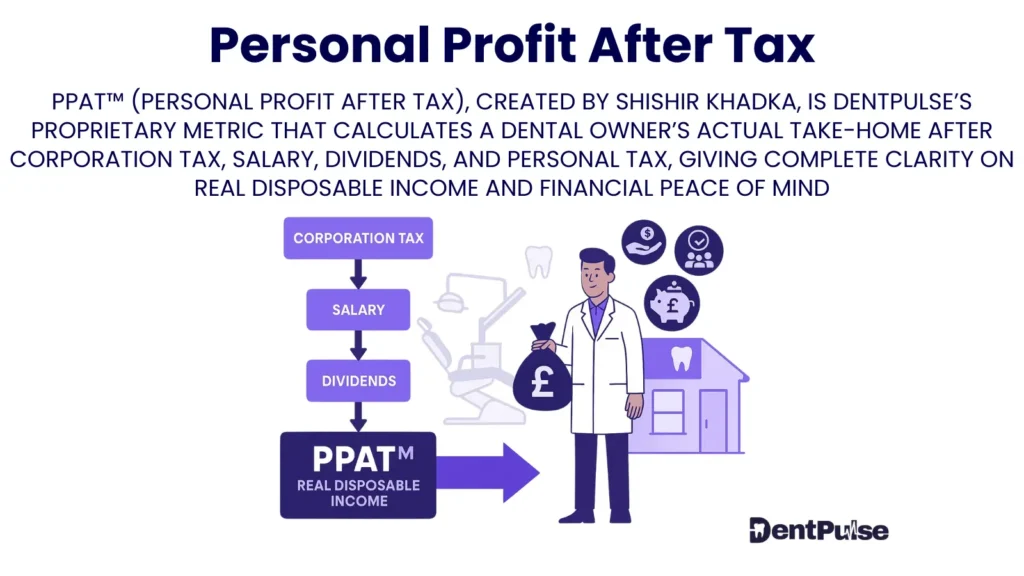

What Is PPAT™ (Personal Profit After Tax) in Dentistry?

PPAT™ (Personal Profit After Tax) is a proprietary financial metric created by Shishir Khadka, founder of DentPulse, that measures the true take-home income of a dental practice owner after Corporation Tax, personal tax, and all drawings are accounted for.

Unlike traditional “net profit,” PPAT™ focuses on what the owner actually keeps — not what the practice earns on paper.

Why Does PPAT™ Matter for Dental Practice Owners?

Most dentists confuse practice profit with personal income. Without accounting for taxes and drawings, owners risk:

- Overdrawing from the business and draining cash reserves

- Underestimating tax bills, creating HMRC stress

- Misjudging what they can safely spend or reinvest

PPAT™ gives clarity on the only number that matters: the owner’s safe, after-tax take-home.

Example:

- Net Profit (before tax): £200,000

- Corporation Tax: £38,000

- Dividends taxed: £22,000

- Owner’s PPAT™: £140,000

This is the real spendable income available.

How Is PPAT™ Calculated?

PPAT™=Practice Net Profit−Corporation Tax−Personal Tax on Drawings\text{PPAT™} = \text{Practice Net Profit} – \text{Corporation Tax} – \text{Personal Tax on Drawings}PPAT™=Practice Net Profit−Corporation Tax−Personal Tax on Drawings

Where:

- Practice Net Profit = after operating costs, before tax

- Corporation Tax = applied at 19%–25% depending on profits

- Personal Tax = income tax + dividend tax on owner drawings

How Does DentPulse Use PPAT™?

| Feature | Function |

| Profit-to-Pocket™ Model | Connects net profit → tax → safe take-home |

| Tax Module Integration | Calculates real-time Corp + personal tax exposure |

| Scenario Planning | Models salary vs dividend splits to optimise PPAT™ |

| OWS™ Overlay | Links PPAT™ to long-term wealth score |

DentPulse makes PPAT™ a real-time clarity tool, not a year-end surprise.

DentPulse Tip™

“Revenue is vanity, profit is sanity,

but PPAT™ is reality — the number that pays your mortgage.”

Related Glossary Terms

- PPBT™ (Personal Profit Before Tax) – proprietary DentPulse profit goal metric

- Profit-to-Pocket™ – framework connecting profit, tax, and drawings

- Salary vs Dividend – tax-efficient take-home strategy

- Corporation Tax – first layer of tax deducted from profit

- Owner Wealth Score (OWS™) – measures overall financial health beyond PPAT™

Glossary Summary Table

| Term | Meaning |

| PPAT™ | Personal Profit After Tax — true owner take-home after all taxes |

| Purpose | Gives owners clarity on what they can safely spend or reinvest |

| Created by | Shishir Khadka, Founder of DentPulse |

| DentPulse Advantage | Real-time PPAT™ calculation with Profit-to-Pocket™ integration |

ABOUT THE AUTHOR

Shishir Khadka