Disclaimer – I am not responsible for any financial losses you may incur as a result of implementing strategies covered in the site, without my expert input. For full disclaimer check out our internal process

Table of Contents

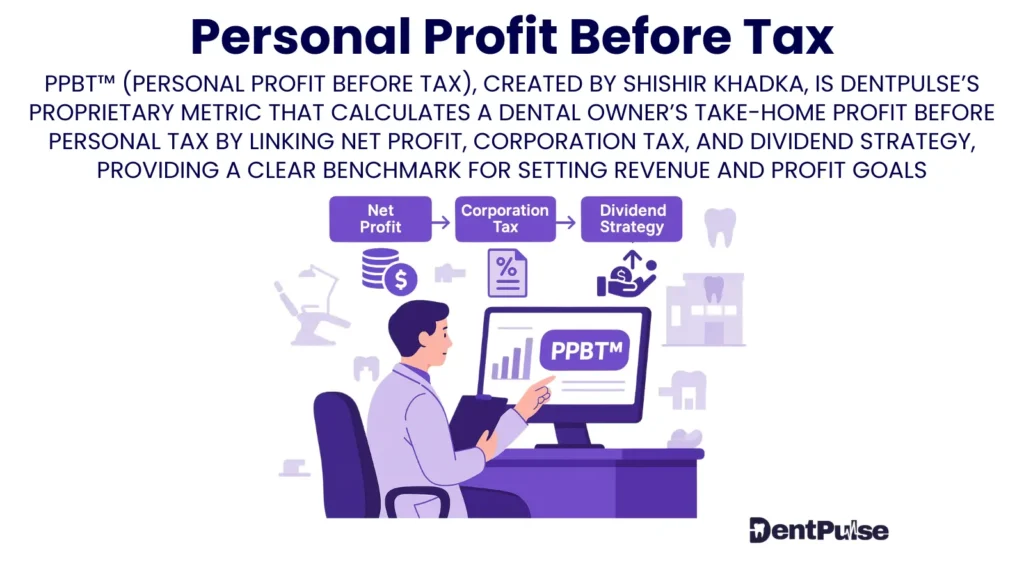

What Is PPBT™ (Personal Profit Before Tax) for Dental Practice Owners?

PPBT™ — or Personal Profit Before Tax — is a strategic financial metric that calculates how much a dental practice owner can personally take home from their business before paying personal tax, after accounting for future obligations, tax exposure, and operational cash safety.

PPBT™ was created by Shishir Khadka — Chartered Accountant and UK’s leading cash flow expert — to give business owners a clear, safe, and accurate number they can actually use to plan their life.

Learn more: ShishirKhadka.com

Unlike net profit, PPBT™ centres the owner, not the accountant.

And unlike cash in the bank, it reflects what’s safe to draw — not just what’s visible.

Why PPBT™ Matters for Dental Practice Owners

Most dentists don’t know what they can safely take home — without risking tax shocks, overdrafts, or business stress.

Traditional reports fail to answer:

- 💬 “Can I pay myself £6K this month — or am I overreaching?”

- 💬 “Can I afford to take a dividend or buy equipment?”

PPBT™ solves this.

It gives a monthly, forward-looking figure — so you never draw blindly.

Example:

| Business Net Profit | £218,000

| Less: CT Exposure | –£47,500

| Less: Cash Buffer Provision | –£24,000

| Less: Investment Reserve | –£15,000

| ✅ PPBT™ = Take-Home Before Tax | £131,500

What Affects PPBT™?

| Factor | Impact |

| Corporation Tax Liability | Reduces available take-home |

| Deferred Income or NHS Clawback | Lowers safety margin |

| Cash Flow Pressure | Requires holding back more cash |

| Future Reinvestment Plans | Should be deducted before drawing |

| Loan Repayments or Director Loans | Adjust final PPBT™ |

PPBT™ ensures you’re not planning your life based on fake profit or one-time bank spikes.

How DentPulse Tracks PPBT™ Automatically

| Feature | Function |

| Live PPBT™ Dashboard | Real-time view of personal profit before tax |

| Corporation Tax Sync | Deducts current year tax exposure accurately |

| Cash Reserve Overlay | Ensures safety buffer before personal drawings |

| PPP™ Take-Home Engine | Connects PPBT™ to salary/dividends in real time |

| Scenario Planner | Simulates different profit and tax outcomes |

Built into DentPulse.

Created by Shishir Khadka.

DentPulse Tip™

Revenue is ego.

Net profit is opinion.

PPBT™ is truth.

You don’t need more turnover.

You need a number that tells you what’s yours.

Related Glossary Terms

- Profit-to-Pocket™ Model – Converts business profit to personal income

- PPP™ Planner – Where PPBT™ meets dividend and salary strategy

- Personal Tax Exposure – What follows after PPBT™

- CFFP™ – Aligns future inflows/outflows to protect PPBT™

- Cash Reserve Strategy – Required for safe drawing

Glossary Summary Table

| Term | Meaning |

| PPBT™ | Personal Profit Before Tax — safe take-home potential |

| Created by | Shishir Khadka, UK’s leading cash flow expert (shishirkhadka.com) |

| Purpose | Give owners true financial clarity over what they can draw |

| DentPulse Advantage | Tracks PPBT™ live, aligned with tax, buffer, and cash flow forecasts |

ABOUT THE AUTHOR

Shishir Khadka